When you are selling different types of products in the VIP hospitality business, you might get confronted with different VAT codes. To ensure the right VAT codes and rates are transmitted to your invoicing system, these codes need to be created in iXpole.

After reading this article you will know how to configure VAT codes in iXpole.

Let's get you started.

In this article we teach you:

- where to find the VAT codes

- how to create a VAT code

- how to modify/remove a VAT code

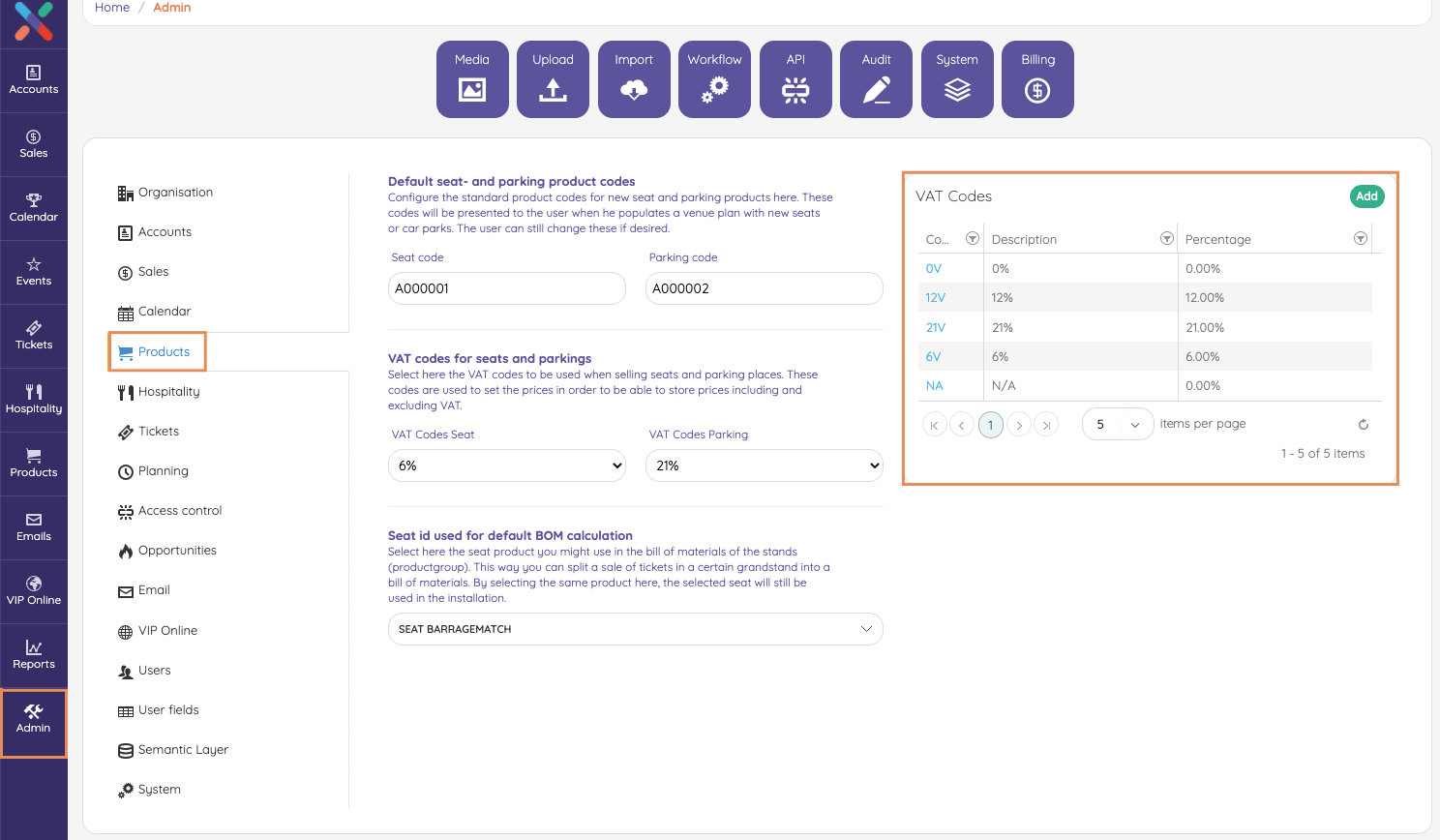

1. Finding a VAT Code

Click on

Admin in the left-side vertical main menu. In the submenu click on Products.On the Products Admin overview page you will see a table with/for VAT codes. Verify if the required VAT codes are already in there.

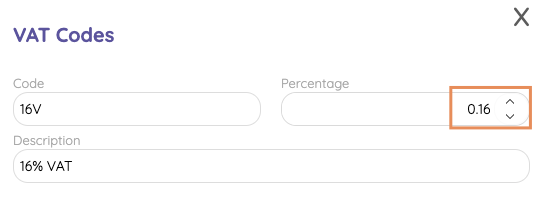

2. Creating a VAT code

If the required VAT codes are not in the table, you will have to create them by clicking on

Add.- Under Code input a code the system can use to refer to this VAT code. This code needs to be alphanumeric without special characters or spacing

- Under Percentage input the VAT percentage as a decimal number (with a decimal point)

- Under Description you can put a description.

Don't forget to click on

Save when you are done3. Modifying/removing a VAT code

locate the VAT code in the VAT table (see 1.) Click on it.

- Modify what needs to be modified and click on

Save - Or click on

Remove